Have you ever needed to negotiate an important deal with a much larger counterpart?

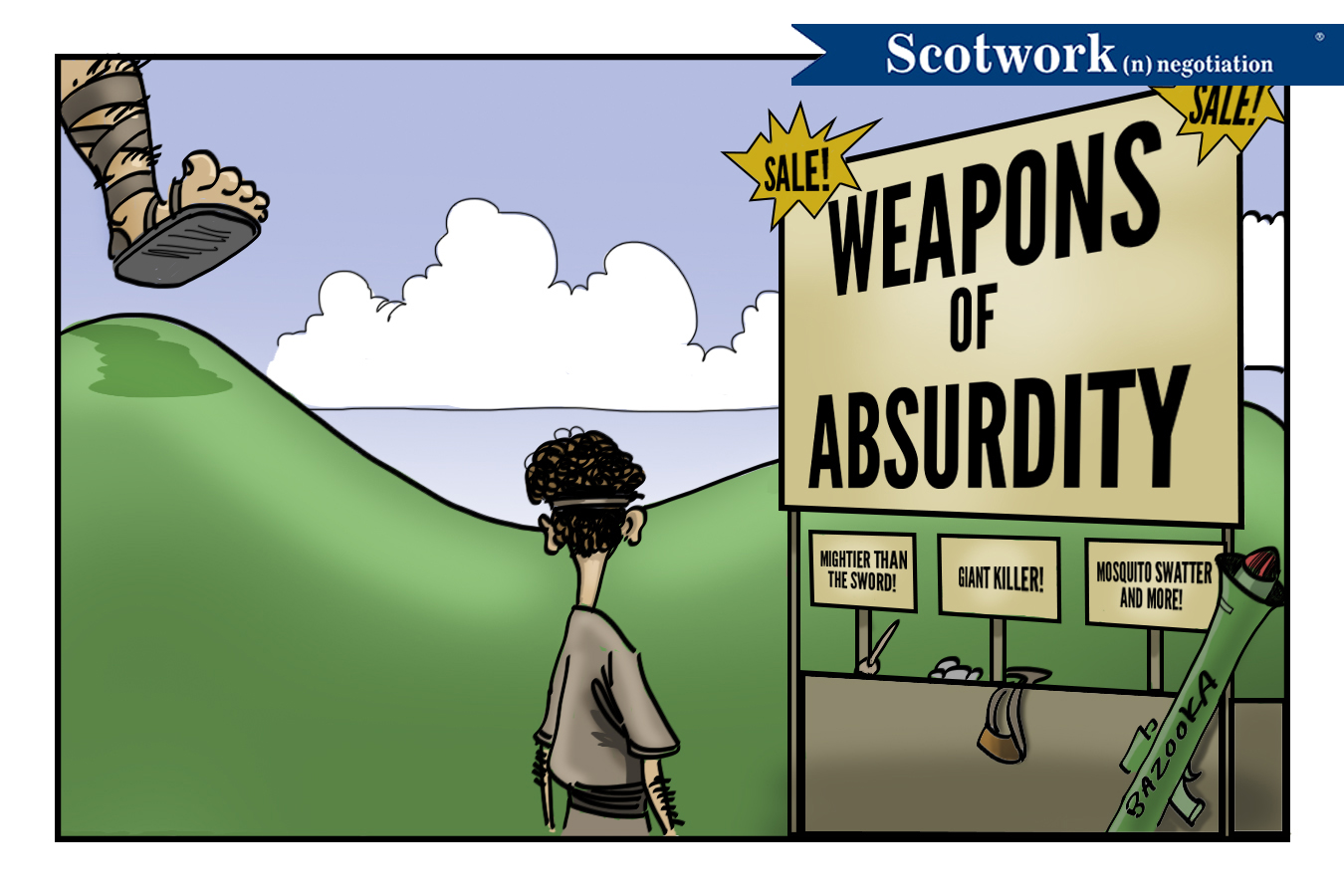

This season of TV’s Survivor is called “David vs Goliath” – a battle between stronger competitors and a bunch of nerds, all fighting it out on a desert island for a million dollars in prize money. I was watching it with my daughters this week (don’t scoff, it’s a great show for scholars of negotiation, game theory AND trash TV) – and it occurred to me that too often we negotiate with a larger party without realizing that we have a slingshot right there in our hands, (or, at least, sitting quietly under the table, if only we’d take the time to look).

We see this frequently when we are advising clients in a mid-sized organization who are trying to close a deal with a much larger organization. When there’s a factor of 10 or 100 between your company’s revenue and that of the other side, it’s easy to find your negotiation being driven from fear, not confidence.

Perceived power is actual power. If you feel you’re holding a strong hand, (even if you’re not), then you’re much more likely to negotiate a good deal than if all your thoughts are laser-focused on our own weaknesses. That little voice on your shoulder is no help at all if it keeps telling you that you’re not good enough, or big enough, or lack something.

Analysis of the Power Balance matters. If you boil it down, negotiators derive most of their power from just three main sources: Incentives (carrots), Sanctions (sticks), and the ability to walk away from the deal if they choose to.

A sales rep who has 85% of their quota tied up with one single account is unlikely to do anything that would risk the relationship. An advertising agency executive who manages a single account is in an even weaker position. They often have no mental “walk away position” – that’s extremely dangerous, and it can drive a master-slave relationship rather than one of two professional peers. But the CEOs of their companies, who might look at these clients as representing 2% of revenue may be much more prepared to lose these account if the commercial terms set a dangerous precedent in a wider market. Why destroy 98% of your market pricing to bend over for a 2% client?

Scotwork is a mid-sized global consultancy - our annual revenue would be a mere footnote for most of our Fortune 500 clients. But we can negotiate with significant power with an $80 billion global business simply by reframing the way we think about power. Even our largest client represents only 3-4% of our global revenue. And it follows that there is some point at which we are prepared to walk away from every single client.

Review your power balance regularly. And make sure you have a limit position on every single account. Pick up that slingshot, David, and negotiate as if you are in the CEO’s seat.

We’re Your Slingshot!

We can help you sleigh the giants at the negotiating table. We can be your advisor, we can be your coach, and we can be your trainer. Whether you bring us to create your strategy, or help you prepare, or develop your team’s negotiating skills - we can be your secret weapon at the negotiating table.

We’ve been consulting and teaching our proven negotiation methodology for over 40 years. We know the process, we can identify the skills required, and we have the techniques to negotiate better deals for you. Call us and let’s discuss what we might be able to do for you.

Talk to one of our experts today.